Over the last few months I've written about patterns and trends in Bitcoin mining while I've been trying to predict how things will evolve. More recently I've built simulations that attempt to model how various trends will affect the mining network. Irrespective of the "improvements", be they improved hashing rates, lower power consumption per hash, lower price per kWh of electricity or higher BTC price, one thing is inescapable: The Bitcoin difficulty increases quickly absorb everything thrown at them in order to maintain the system's block finding rate. This has very significant implications for the not-too-distant future.

The role of difficulty

The Bitcoin difficulty concept is a very elegant approach to ensure that no matter how the hashing infrastructure changes the intrinsic timescales envisaged for Bitcoin mining stay essentially the same. The design allows for the system to remain computationally stable and secure as technology changes and expansions in the numbers of participants take place. It also helped solve a problem of how to start up (bootstrap) the mining network. Mining could use commodity hardware that already existed and had other purposes. It also required no capital investment, just the additional cost of running PCs at higher CPU loads than they had been.

As Bitcoins started to become worth money, however, the prospect of mining a larger share of them has been ever more enticing. Mining became an end in itself, rather than just a means to support the transmission of Bitcoins. Once mining became seen as valuable there was a clear challenge to any intent that miners would co-operate for the good of the network. Instead individuals could gain an advantage, albeit at the expense of everyone else. The behaviour of miners essentially became a real-world prisoner's dilemma.

Prisoner's dilemma

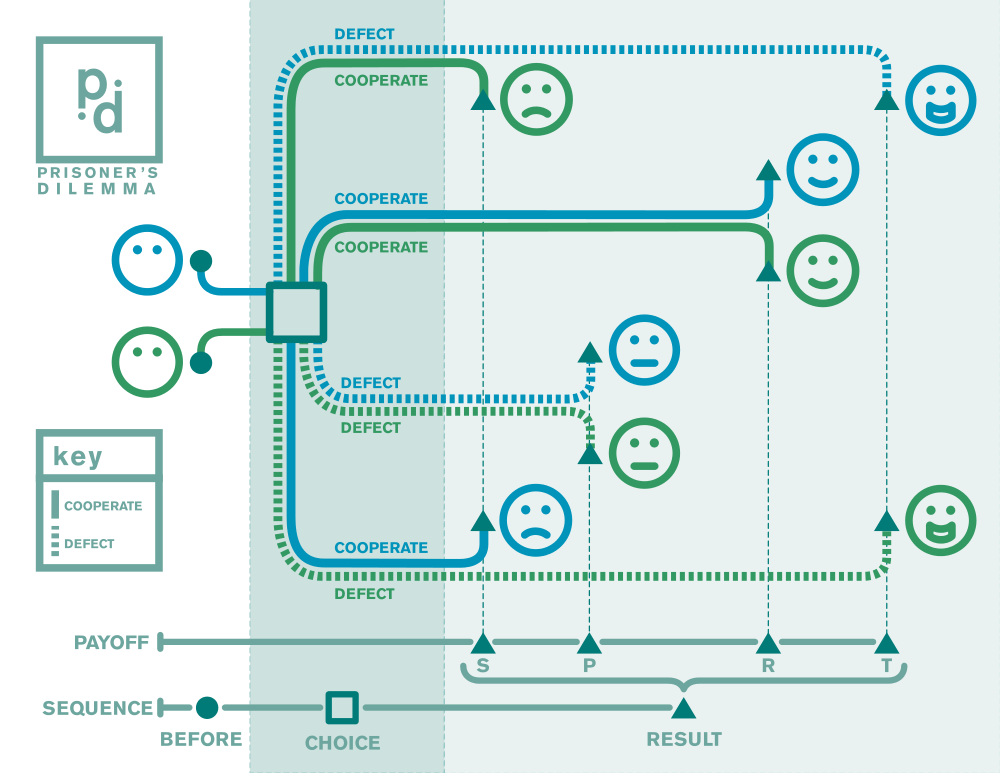

In the prisoner's dilemma, two prisoners, A and B, suspected of committing the same crime (and for which there is no other evidence) are arrested and held such that they cannot communicate with each other. Each has a choice: confess (known as defecting) or remain silent (known as cooperating).

The choices lead to 4 possible outcomes:

- A and B both stay silent: both go free.

- A and B both confess: both get 2 years in jail.

- A confesses and B stays silent: A gets 1 year in jail and B gets 3 years in jail.

- A stays silent and B confesses: A gets 3 years in jail and B gets 1 year in jail.

Clearly the best option is for both to stay silent (neither acts to harm the interests of the other), but the average outcome is: (0.25 * 0) + (0.25 * 1) + (0.25 * 3) + (0.25 * 2) = 1.5 years in jail. The potential risk of getting 3 years in jail is probably enough to have more confess than not but there's no strong favourite position. If A confesses then it's a 50:50 chance of a positive or negative result

Now imagine the same game but with 3 members of the same criminal gang - if any one confesses either of the others who stays silent get the full 3 year penalty, while all those who do confess get just 1 year in jail. There are 8 possible options here and the average result is still 1.5 years in jail. Now, however, if A stays silent then only 1 out of the 4 outcomes is positive (0 years) and 3 out of the 4 are the most negative (3 years). Remaining silent now carries an average cost of 9/4 = 2.25 years in jail. Conversely confessing now carries an average cost of 5/4 = 1.25 years in jail!

This is the core of the problem with Bitcoin difficulty, but the outcomes are slightly different. With mining we have a zero sum game (the total result however played is the same). Consider 2 miners:

- A and B have the same hardware: Both get 50% of the mining reward.

- A and B both double their hashing rates: Both get 50% of the mining reward.

- A doubles their hashing rate but B does not: A gets 67% of the mining reward, B gets 33%.

- A keeps the same hardware but B doubles their hashing rate: A gets 33% of the mining reward, B gets 67%.

In this version the average is still 50% of the total, but now defecting (increasing hashing rate) averages 58.3% of the mining reward vs 41.7% for cooperating. If we play the same game with 3 miners then all start with 33.3% of the total, but cooperating averages only 26% and defecting averages 41%. Statistically it seems obvious that defecting and doubling hash rates leads to the best outcome. Of course all of the miners know this so where possible they will always defect; it becomes an ongoing race to try to continually leapfrog the other players. Sometimes a player will choose to leave the game but then another will likely try to join and ultimately no-one gains an advantage.

Interestingly one of Satoshi Nakamoto's last public posts (2010-12-12) alluded to this same problem: "We should have a gentleman's agreement to postpone the GPU arms race as long as we can for the good of the network". It's unclear just how far he had gone in thinking about this though.

This then is the headache for mining. The headlong race of miners trying to prevent anyone else from outdoing themselves simply leads to a point where all of the resources that each miner can bring to bear end up fully consumed in the arms race itself. A very small number of miners will make money (where they have a short-term advantage) and exit the game, while most will make long-term losses.

The runaway mining headache

As with gold rushes of the past, most of the money has recently flowed to suppliers who have enabled ever-larger-scale mining. While much more efficient than previous generations the difficulty levels increased exponentially to absorb the improvements and the trend towards ever-increasing operating costs was simply deferred, not prevented. A short term respite has recently seen a move to locations with lower cost electricity suppliers but this has simply freed up money to spend on yet more hashing capacity and that in turn requires more electricity. There are probably a few more short term improvements that might be made, such as utilizing waste heat in some more useful way, but these too only act to make more money available to increase hashing capacity. Even BTC price increases only offer temporary respite. Whatever the cause, the difficulty level increases accordingly and this quickly negates any benefits.

It's already apparent that difficulty level increases are also affecting the price of hardware. This has started to fall in order to offer any potential prospect of useful mining rewards. Technology limits mean that technology improvements do not offer a path to enable the necessary cost reductions, so hardware vendors margins are being cut too. Inexorably the balance will continue to move towards operating costs consuming almost all of the available mining rewards.

In traditional "arms race" problems the participants often end up mutually agreeing to try to de-escalate things and verify that all parties have honoured their commitments, but the decentralized nature of Bitcoin mining means that such agreements are all but impossible; the participants just aren't knowable.

Other cryptocurrencies have tried to prevent an arms race by making things harder for custom hardware. While this relieves some short-term pressure any computational problem ends up susceptible to the same economic pressures. Given the scope of Bitcoin mining deployments it seems improbable that changing the core hashing algorithm would be an option anyway.

Early miners and ASIC suppliers have already seen their profits, and indeed may still earn more yet. They can sit on a sunny beach sipping champagne cocktails, but as the difficulty levels eat into everyone else's margins it's unclear how the mining dilemma can end up having a happy ending for anyone else but the energy suppliers.

Acknowledgments

The last line of this article was rewritten thanks to an insightful remark when I first posted a link to it!